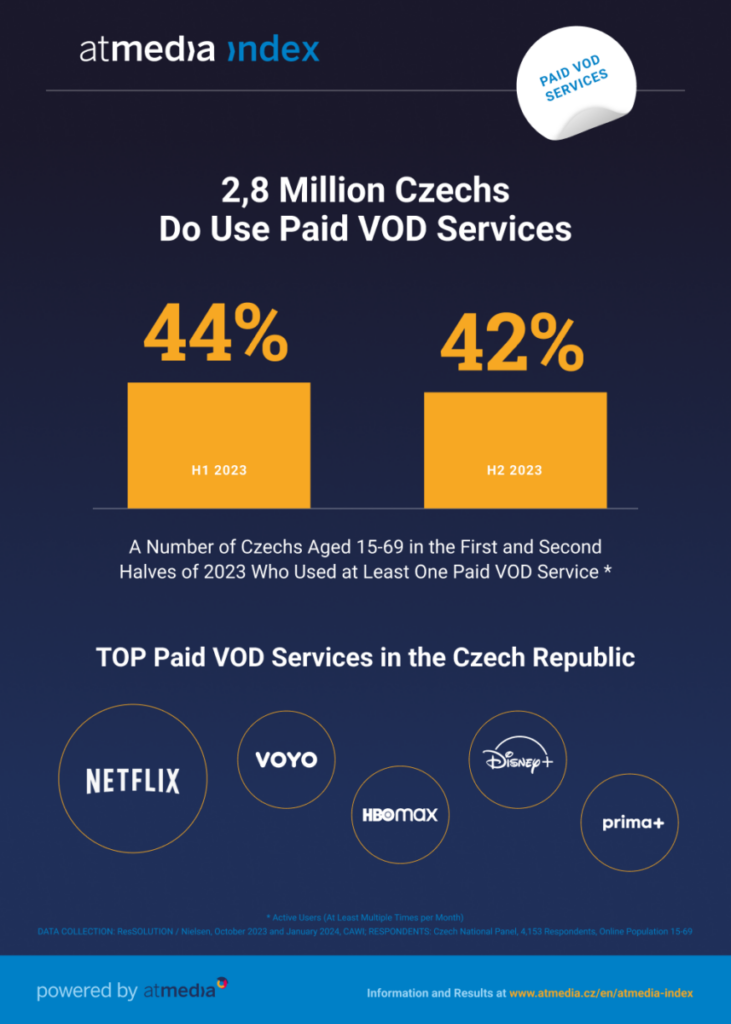

Over the past few years, the Czech Republic has witnessed a remarkable surge in VOD services, with a growing number of viewers willing to pay for subscription-based platforms. However, this momentum experienced a bit of a slowdown last year. Nonetheless, according to the recent findings of the Atmedia Index survey research study, despite a slight decrease in user numbers during the second half of 2023 compared to the first half, the overall year-on-year comparison indicates a modest increase.

According to the results of the Atmedia Index survey study, carried out regularly every three months by the Atmedia sales house, it is further revealed that from January to June, 44% of the Czech population aged 15–69 used at least one paid Video-on-Demand service several times a month. From July to December, the percentage dropped to 42%. ‘During the second half of 2023, a total of 2,8 million individuals aged 15–69 did actively use paid VOD services, which is more than 150,000 fewer people than in the first half of the year. However, it does not imply that the paid VOD service market has reached its saturation point. On the contrary, in year-on-year comparison, the number of users actually increased by two percentage points,’ declares Pavel Müller, Head of Research & Marketing at Atmedia, a company representing 24 measured thematic TV channels on the Czech market.

Millennials Take the Crown as the Most Avid Users of Paid VOD Services

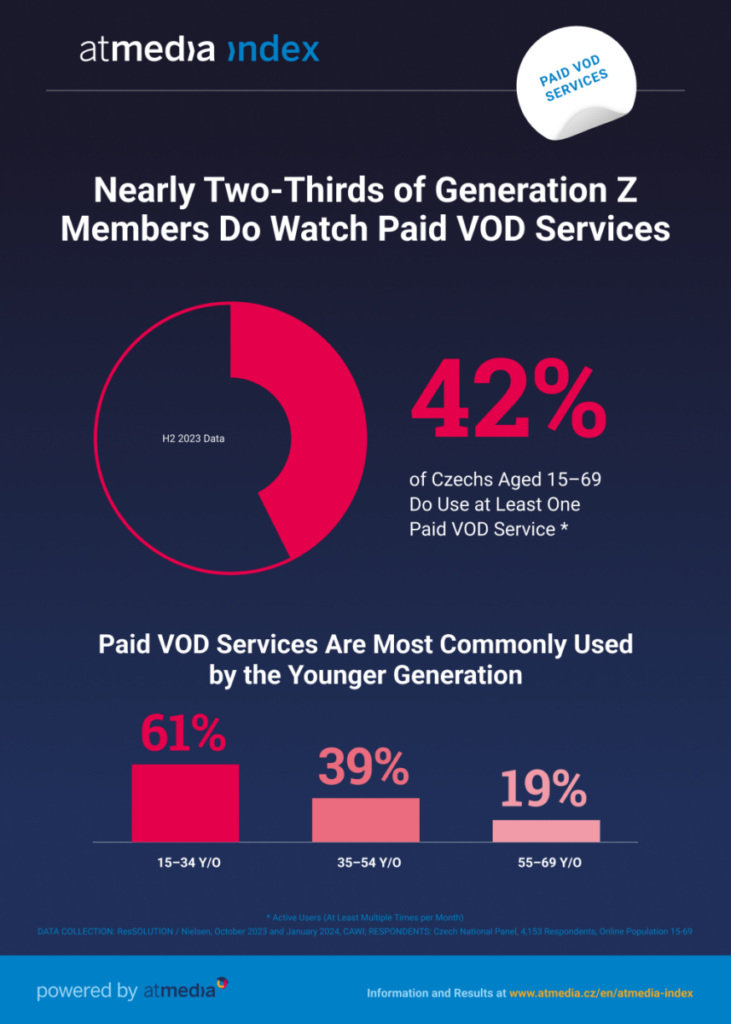

Paid VOD platforms such as Netflix, HBO Max, or Disney+ are particularly favoured among members of Generation Z and Millennials, encompassing individuals aged 15–24 and 25–34. A combined total of 61% of this demographic segment are avid viewers of these services. ‘Based on the latest results of our Atmedia Index survey research, 63% of individuals aged 15–24 and 60% of those aged 25–34 do actively use paid Video-on-Demand services. These figures stand out as the highest percentages among all surveyed age groups,’ claims Pavel Müller, while asserting that the use of paid VOD services decreases with age – specifically, in the second half of 2023, only 39% of individuals aged 35–54 and 19% of those aged 55–69 did actively use these services. ‘The youngest generation frequently opts for digital platforms that provide personalised content and the actual flexibility to enjoy series and movies at their own convenience, regardless of their whereabouts – they seek the ability to watch series and films at their own convenience, wherever they are. This explains the widespread popularity of paid VOD services among this particular group, as well as the appeal of features such as catch-up TV,’ adds Pavel Müller.

The Atmedia Index further revealed that over four-fifths of paid VOD service users tune in to content on these platforms at least several times a week, with the majority doing so daily or nearly every day. Millennials, individuals aged 25–34, are in fact the most avid consumers of video content on these particular platforms. Almost 60% of them do watch content on a daily basis or nearly-daily one, with an additional 30% tuning in at least several times a week. Interestingly, users aged 55–64 do come next, with over half of them being classified as daily users. ‘The frequency of viewing differs across various paid VOD services. While some do have over a third of daily users, others have fewer than a fifth,’ affirms Pavel Müller.

TOP 5 Players Are Accompanied by Platforms That Do Attract Fewer Than a Tenth of VOD Service Users

The latest Atmedia Index study results for the latter half of last year also reveal that, on average, one VOD service user does actually use two services concurrently. Moreover, the ranking of the most popular paid Video-on-Demand services remains unchanged compared to the first half of 2023. ‘From the perspective of the number of their users, paid VOD services could be divided into three or four groups,’ says Pavel Müller, while adding that the first group comprises a single player – Netflix – which, from July to December last year, was used by two-thirds of all paid VOD service users. ‘In the second group, coming after Netflix at a considerable distance, we might place platforms such as Voyo, HBO Max, Disney+, and Prima+. The third tier then includes services like SkyShowtime, Amazon Prime Video, FilmBox+, or CANAL+, where the share of viewers does not exceed one-tenth of all paid VOD service users,’ explains Pavel Müller. He suggests that the fourth category could include services aimed at small, niche audiences with lower single-digit percentages.

About the Survey Study

The survey research study has been conducted for Atmedia – the media representative of thematic TV channels – by the research company ResSOLUTION / Nielsen using the CAWI method. The survey did single out 4,153 respondents (online population aged 15–69) from the Czech National Panel. The survey was carried out in two data collection waves during Q3 and Q4 of 2023 (2.10. 2023 –16.10. 2023, 2.1. 2024 – 15.1. 2024).

Atmedia introduced the Atmedia Index study in mid-2021. It does provide the TV channels, media agencies, and other interested parties a comprehensive data, information, and insights into the three researched areas: (1) TV channels’ quality evaluation through their viewers’ eyes, (2) use of Pay-TV and Free TV, (3) use of paid Video-on-Demand (VOD) services.

About Atmedia

Atmedia Czech s.r.o. is a media sales house of almost 30 thematic TV channels, which has been active on the Czech market since 2008. Atmedia does handle the selling of TV advertising, and it currently represents many local as well as most of the international TV channels and TV groups on the Czech TV market, in particular AMC Networks, Warner Bros. Discovery, The Walt Disney Company, Antenna Group, or the Slovak JOJ group. At the beginning of 2010, Atmedia introduced the market to a very unique way of selling the advertising space via sales packages. Since 2021, has been regularly publishing the Atmedia Index, a valuable resource providing extensive data, information, and insights in three key domains: (1) the evaluation of television channels’ quality through the eyes of their viewers, (2) adoption and usage of Pay-TV and Free-to-Air services, (3) adoption and usage of subscription Video-on-Demand (SVoD) services.