Pay-TV spending among Czechs has risen to an average of 419 CZK per month, reflecting operators’ recent price hikes. Yet, up to a third of viewers reliant on free digital terrestrial broadcasting do find this price point to be excessive. These insights are drawn from the latest Atmedia Index research, a survey study regularly carried out by Atmedia – media sales house of thematic TV channels on the Czech market. Notably, for the first time, the study incorporates a price sensitivity test, delivering new perspectives on viewer preferences.

Over the second and third quarters of this year, average monthly spending on Pay-TV services have seen a 7% year-on-year increase, now amounting to 419 CZK. ‘In the same period last year, Pay-TV viewers did spend an average of 391 CZK per month, staying below the 400 CZK mark,’ says Pavel Müller, Senior Head of Research & Marketing at Atmedia. He also remarks that O2 TV and Skylink are examples of Pay-TV operators that increased their 2024 rates.

Even with increasing prices, the number of TV viewers subscribing to Pay-TV services has steadily grown in recent years. ‘Our Atmedia Index research study underscores a notable rise in IPTV usage,’ clarifies Pavel Müller. He further explains that Czech TV viewers choose Pay-TV operators for several reasons, with the most common being the ability to watch programmes on demand. Secondary drivers include the flexibility of multi-device streaming and access to channels not offered via free terrestrial broadcasting services.

Over 100 TV Channels for Less Than CZK 200 a Month?

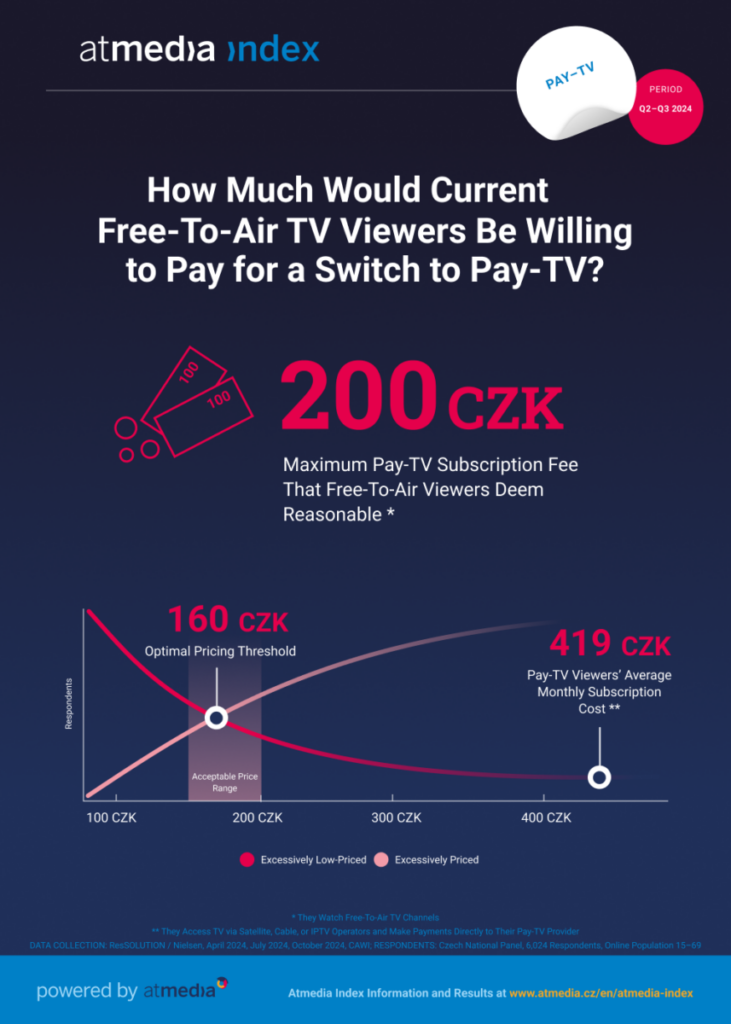

Despite the expansion of Pay-TV in recent years, Free-To-Air TV channels remain a mainstay for a large number of Czech households. ‘Our Atmedia Index research study data does show that nearly a third of viewers either balk at paying for TV reception, or deem Pay-TV prices excessive,’ discloses Pavel Müller. He adds that the survey study has now been expanded to include the so-called price sensitivity test, designed to determine the ideal pricing, the acceptable price range, and the thresholds respondents consider too high or too low. ‘We inquired with these price-sensitive viewers about the maximum amount they’d be willing to pay for Pay-TV services,’ Müller explains.

So, what Pay-TV price point do these viewers consider optimal? ‘According to Czech TV viewers who solely rely on the free terrestrial broadcasting, the acceptable price range for Pay-TV services is 150 to 200 CZK per month,’ reveals Pavel Müller, sharing the outcomes of the price sensitivity test, while also noting that for this price, viewers expect an access to over 100 TV channels, with more than 70 available in HD, plus an on-demand viewing and recording, and the flexibility to stream content on four devices at once. ‘To ensure relevance, we did define the service parameters to closely mirror those offered by leading Pay-TV operators on the Czech market,’ states Pavel Müller, commenting that this year, more operators, such as the newly launched Pecka.TV and Skylink with its TV+ package, have targeted price-sensitive customers.

Atmedia Index

The survey research for Atmedia – sales house of thematic TV channels – was carried out by the ResSOLUTION research company using the CAWI method. The survey involved 6,024 respondents from the Czech National Panel (online population aged 15–69). The survey took place in three waves from first to third quarter of 2024 (April 5–22, 2024, July 3–23, 2024, and October 4–23, 2024). Atmedia introduced the Atmedia Index in mid-2021. It offers media agencies and other interested parties a comprehensive data, information and insight into two researched areas: (1) use of Pay-TV and Free-to-Air TV, and (2) use of paid video on demand (SVOD) services.