The number of viewers tuning in to television channels through Pay-TV operators has remained consistent for several years, with last year being no different. These findings are reaffirmed by the latest results of the Atmedia Index survey research, a quarterly study conducted by Atmedia sales house. Moreover, the study also underscores the Czech Pay-TV market’s structure, which is predominantly controlled by four major players, collectively holding sway over three-quarters of its landscape.

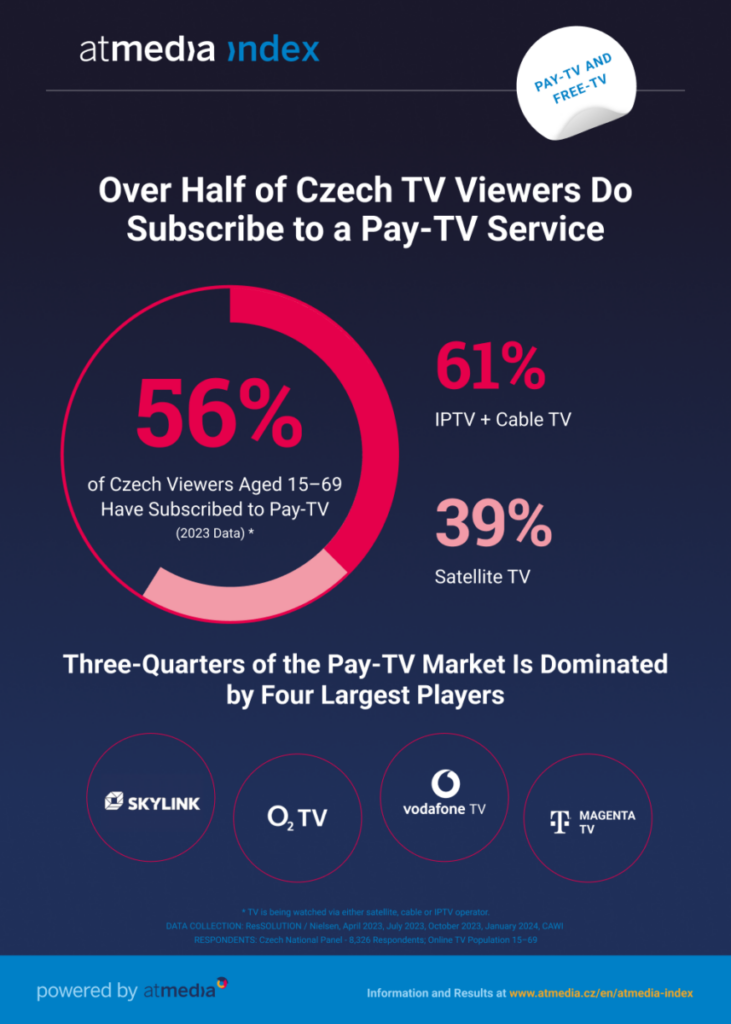

In 2023 specifically, 56% of viewers aged 15–69 did opt for Pay-TV services. Notably, IPTV emerges as the frontrunner, steadily expanding its market share at the expense of satellite television. ‘Last year, 61% of Pay-TV viewers used either IPTV or cable television, with the remaining 39% choosing satellite,’ explains Pavel Müller, Head of Research & Marketing at Atmedia, a media sales house currently representing 25 measured thematic television channels on the Czech market. According to the Atmedia Index research study, the entirety of the Pay-TV market’s three-quarters is controlled by the four major operators: Skylink, O2 TV, Vodafone TV, and Magenta TV.

Exclusive Sports Content Is Important to Every Sixth Pay-TV User

‘The main drivers behind the subscription to Pay-TV operators’ services do include time flexibility, a diverse selection of video content, and the convenience of simultaneous viewing of different TV programmes by multiple family members,’ summarises Pavel Müller. He further emphasises that TV viewers do choose services like O2 TV, Vodafone TV, Magenta TV, or other Pay-TV operators primarily for the convenience of an on-demand viewing, irrespective of the original broadcast time. This aspect was specifically highlighted by 41% of viewers who used satellite or cable TV, or IPTV last year. Following close behind, with 38%, is the ability to access TV channels not offered in digital terrestrial broadcasting. The third most prevalent reason, acknowledged by 28% of Pay-TV viewers, is the convenience of watching TV on multiple devices at the same time, such as PC, tablet, or mobile.

Less commonly noted reasons for subscribing to Pay-TV services include the option to watch TV channels in HD quality and access to video content not available through traditional linear TV channels, such as a wide selection of movies and series offered across different video libraries. ‘Exclusive sports content is deemed important by approximately one in six Pay-TV users,’ states Pavel Müller, while highlighting that in recent years, sports content has evolved into a competitive advantage and Pay-TV operators’ hallmark, some now boast offerings of more than twenty dedicated sports TV channels.

Czechs Do Spend Around Four Hundred Czech Crowns for Pay-TV Subscription a Month

The Atmedia Index study has also been tracking the average monthly expenditure on Pay-TV services. In the second half of last year, Czechs spent an average of 395 CZK per month for Pay-TV operators’ services, marking a marginal increase compared to the same period in 2022. ‘Despite the availability of Pay-TV services for less than a hundred crowns a month, the price still remains a predominant factor why 44% of television viewers aged 15–69 do exclusively choose to watch television channels available in digital terrestrial broadcasting,’ comments Pavel Müller, while pointing out that one-third of these viewers consider Pay-TV to be expensive. Nearly half of the viewers abstaining from Pay-TV simply do not wish to pay for it at all. Nonetheless, the most commonly cited reason for not opting for Pay-TV services remains the satisfaction with the array of television channels accessible via terrestrial broadcasting. ‘Czech viewers do have an access to dozens of Free-to-Air television channels, with nearly forty of them being part of the official television viewership measurement,’ observes Pavel Müller, noting that terrestrial broadcasting maintains a strong position in the Czech Republic, a trend expected to persist in the years ahead.

About the Research

The survey research for Atmedia – sales house of thematic TV channels – was carried out by the ResSOLUTION research company / Nielsen using the CAWI method. 8,326 respondents (online TV population aged 15–69) from the Czech National Panel entered the questionnaire survey. The survey took place in four waves for every quarter of 2023 (5th– 19th April 2023, 3rd– 31st July 2023, 2nd– 16th October 2023 and 2nd-15th January 2024).

Atmedia introduced the Atmedia Index in mid-2021. It offers TV channels, media agencies and other interested parties a comprehensive data, information and insight into three researched areas: (1) TV channels’ quality evaluation through the eyes of their viewers, (2) use of Pay-TV and Free-to-Air TV, (3) use of paid video on demand (VOD).

About Atmedia

Atmedia Czech s.r.o. is a media sales house of almost 30 thematic TV channels, which has been active on the Czech market since 2008. Atmedia does handle the selling of TV advertising, and it currently represents many local as well as most of the international TV channels and TV groups on the Czech TV market, in particular AMC Networks, Warner Bros. Discovery, The Walt Disney Company, Antenna Group, or the Slovak JOJ group. At the beginning of 2010, Atmedia introduced the market to a very unique way of selling the advertising space via sales packages. Since 2021, has been regularly publishing the Atmedia Index, a valuable resource providing extensive data, information, and insights in three key domains: (1) the evaluation of television channels’ quality through the eyes of their viewers, (2) adoption and usage of Pay-TV and Free-to-Air services, (3) adoption and usage of subscription Video-on-Demand (SVoD) services.