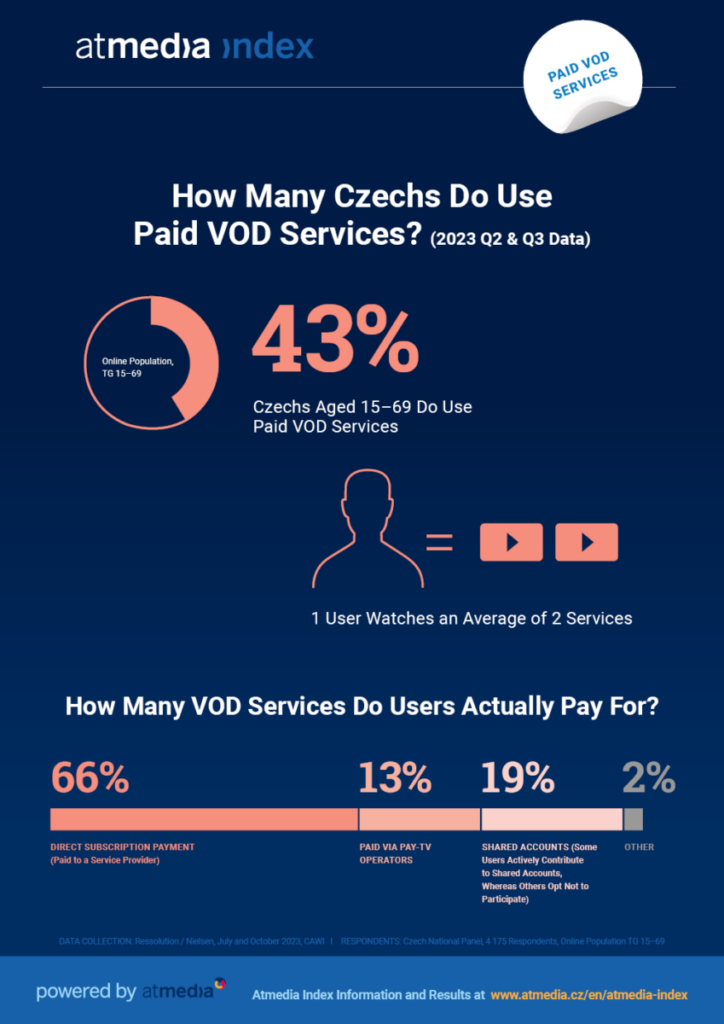

The latest Atmedia Index results, covering the second and third quarters of this year, do indicate that 43% of Czechs aged 15–69 do access at least one paid VOD service multiple times a month, totalling 2,8 million individuals. A regular survey conducted by Atmedia – media representative of thematic TV channels – consistently shows that Czech viewers do commonly use multiple paid VOD services at the same time, averaging two services per user. However, it is important to note that not everyone actually subscribes to all streaming services used.

“When discussing the 2,8 million Czech viewers who, on average, use 2 paid VOD services, we’re actually referring to approximately 6,5 million active accounts or logins. Yet, about one-fifth of these do belong to the shared accounts, indicating that users share them with family members or friends. Some do chip in for the shared account access, while others opt not to contribute,” explains Pavel Müller, Atmedia’s Head of Research & Marketing. He further adds that the proportion of shared accounts varies across specific paid VOD services, ranging from 18% to 24% for the most frequently used ones.

According to the Atmedia Index survey findings for the second and third quarters of this year, users who directly subscribe to VOD service providers do spend an average of 333 CZK per month. When it comes to average monthly subscription fees, Netflix takes the leas as being the priciest, with other widely used paid VOD services showing a comparable average monthly fees.

Netflix, Voyo, HBO Max, Disney+ and Most Recently Also Prima+

Netflix has continuously secured its leading position as the most popular paid VOD service on the Czech market, chosen by more than two-thirds of streaming service users. According to the insights of the Atmedia Index survey for the second and third quarters of this year, the TOP 5 paid VOD services also feature Voyo, HBO Max, Disney+, and Prima+. “Since the beginning of 2023, the ranking of the most used paid VOD services has remained quite consistent. It solidified following the entry of Disney+ in June 2022, and the introduction of Prima’s streaming service, Prima+, in February 2023. Both platforms quickly established themselves within the TOP 5 streaming services on the Czech market,” elaborates Pavel Müller. He additionally observes that recent newcomers such as SkyShowtime or CANAL+ have not led to a substantial reshuffling in the rankings.

Content as the Primary Driver for Using VOD Services

As revealed by the Atmedia Index survey results for the second and third quarters of this year, Czech viewers are drawn to paid VOD services for several reasons, calling attention to original content as being a major factor which attracts viewers to specific streaming services. As per the survey findings, users predominantly opt for specific VOD services because they wish to access particular shows, be it movies or series. Another motivation is the capability to select video content based on their current mood, coupled with the extensive variety of available video content. “While paid VOD services do provide users with benefits such as the ad-free viewing and the flexibility to watch content at any time and place, the primary motivation for using streaming services remains the content itself,” asserts Pavel Müller. He also points out that there are differences in perceived benefits among various paid VOD services. “For instance, local VOD services do provide an additional benefit of accessing video content before it becomes available on TV,” explains Pavel Müller.

About the Research

The survey research for Atmedia – sales house of thematic TV channels – was carried out by the ResSOLUTION research company / Nielsen using the CAWI method. 4,175 respondents (online TV population aged 15–69) from the Czech National Panel entered the questionnaire survey. The survey took place in two waves for the first and second quarters of 2023 (3rd–31st July 2023, 2nd–16th October 2023).

Atmedia introduced the Atmedia Index in mid-2021. It offers TV channels, media agencies and other interested parties a comprehensive data, information and insight into three researched areas: (1) TV channels’ quality evaluation through the eyes of their viewers, (2) use of PAY-TV and FREE TV, (3) use of paid video on demand (VOD).